Table of Content

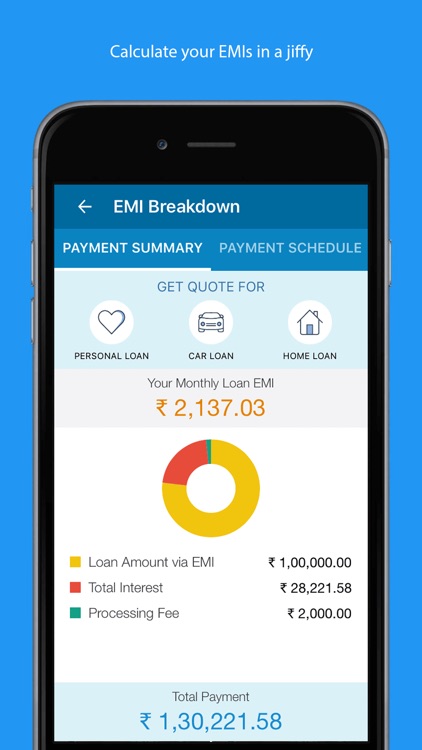

For the housing loan to be sanctioned, you’ll have to provide your identity proof and address proof, income documents such as ITR and payslips, bank statements, and proof of house purchase. This fee is charged by banks for processing your loan application. It is non-refundable and is charged before disbursal. It’s calculated either as a percentage of the loan amount or is a fixed amount. Our EMI calculator helps you calculate the amount you have to pay the bank every month. Input your loan amount, tenure, interest rate, and processing fee to get your EMI and loan amortisation details.

Perhaps, that is true for anything that is used as a last resort. Last 3 month’s / 6 month’s personal and business bank statements. With demonetisation, you can’t really pay for anything in cash anymore, and with property prices on the rise, it is nigh on impossible to buy a house without a Home Loan.

Home Loan Interest Rate of all Banks 2022

After you apply the formula to calculate your home loan EMI, the monthly instalment amount comes up to ₹ 27,285. We'll ensure you're the very first to know the moment rates change. Can I avail tax deductions on my home loan? Yes, you can avail tax benefits on both the interest and principal component paid against your home loan. As per Section 80C of the Income Tax Act, you can avail deductions up to Rs.1.50 lakh on the principal amount repaid annually. LIC HFL Home Loan for Pensioners/Senior Citizen Low interest rates starting from 6.90% p.a.

Home loan eligibility criteria has common parameters across all banks and Non-Banking Financial Companies . However, there could also be specific criteria that is applicable for each lender according to their requirements. Understanding the criteria that is required to be eligible for a home loan helps to ensure that the process of application becomes smoother and easier for you. There are more hidden charges which was informed later this was the only issue.

Check Documents Required for Home Loan

Having too many ongoing loans will not only impact your personal finances but also your repayment capacity. Hence, it is advised to clear the ongoing loans, if any, before you apply for a housing loan. In case you have a poor credit score, consider improving your score by making your debt repayments on time before you reapply for a housing loan again. If you do not know what your current score is, you can get your credit score along with the credit report on BankBazaar. Avail home loans up to Rs.10 crore with interest from 6.60% p.a., processing fees from 0%, and repayment tenure up to 30 years through BankBazaar. Once you have put the loan amount and tenure of the loan on the EMI calculator, the next thing you need to enter is the interest rate offered by your preferred bank.

Interest rates are the charges a lender will levy on you for borrowing a certain amount over a specific period. These rates will differ from one lender to another. It’s used much more liberally compared to loan restructuring and unlike it, the use of loan refinancing is not limited to tackling severe financial distress.

Home loan repayment: Opting for longer tenure? Here's what it could mean for mortgage borrowers

Yes, you can avail housing loans for under construction properties. However, it should be kept in mind that the amount will be disbursed in instalments as per the assessment of the lender. Once you have figured out your eligibility for a home loan, you can check home loan interest rate for all banks and apply for the one that suits you best. Calculation of home loan EMI is a simple method using an excel spreadsheet. In order to do so, three variable of a housing loan is utilised, namely, rate of interest, period, and loan amount. It must be noted that the rate of interest should be calculated on a monthly basis.

This is a jump of Rs 2,776 per month or Rs 33,312 per year. In the aftermath of the COVID-19 pandemic, real-estate prices have crashed while Home Loan rates have fallen to historical lows. If you’ve been mulling the idea of buying your own home, 2021 could be the year to take the plunge. We’ve lined up the top Home Loans for you to help finance your dream home. It is because the initial phase of repayment term is when borrowers repay majority of the interest component, while the principal amount is pushed to the second half. Home equity loans don’t restrict one to use the loan money in specific ways.

Things to Know Before Taking Home Loan

Do not be attracted by schemes that do not require any down payment. If you apply for a home loan without paying any money upfront, then you might not realise and pay more interest. Also, the more money you pay as down payment, the lower your EMIs will be, which means that you will be able to repay your loan earlier. I took home loan from MAGMA HOUSING FINANCE on 6 months back , the loan duration of 20 years for the amount of 18L.

You can easily check the various Home Loan rates offered by different banks online and enter this in the calculator. All information including news articles and blogs published on this website are strictly for general information purpose only. BankBazaar does not provide any warranty about the authenticity and accuracy of such information. BankBazaar will not be held responsible for any loss and/or damage that arises or is incurred by use of such information. Rates and offers as may be applicable at the time of applying for a product may vary from that mentioned above.

This facility would be available for a period not exceeding 12 months. A Home Loan EMI Calculator is an online calculator that lets you calculate your monthly loan instalment amount with ease. All you need to do is enter your preferred loan amount, the interest rate offered, and loan tenure.

The scenario has been more difficult for the borrowers of shorter loan tenure, as the hike in interest rates directly impacts the monthly installment amount. How to Get Lowest Home Loan Rates in India? Home loan interest rates are at a 15-year low, so almost all the banks are offering lower interest rates on home loans compared to what they were offering in the previous financial year. However, to get the lowest home loan interest rates, compare rates offered by lenders. Always use a home loan EMI calculator while comparing rates; it will help you estimate how much you have to pay every month against your loan. A joint home loan can be availed by adding a co-applicant such as your spouse, parents, or an immediate family member on your application.

However, with a bad score lenders will doubt your repayment capability and might not consider you to eligible for a home loan. Does having a personal loan affect home loan eligibility? However, other ongoing loans ultimately tend to affect your eligibility as your overall spending power is reduced. If your other loan commitments exceed 50%-60% of your monthly income, your home loan application may be rejected. The Reserve Bank of India increased the repo rate by 35 basis points to 6.25 per cent this month. Because of the rise in repo rate, various public and private sector banks have been hiking the home loan interest rates.

No comments:

Post a Comment